From NY Times, Jun ’17:

**

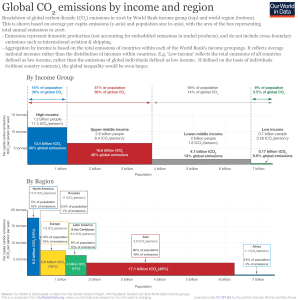

From Our World in Data, Oct ’18:

**

From Axios, Dec ’18 (source chart here):

**

From NY Times, Jun ’17:

**

From Our World in Data, Oct ’18:

**

From Axios, Dec ’18 (source chart here):

**

Quick placeholder for the panel that I joined yesterday at Fintech Connect:

Will share thoughts and observations soon.

From “A new book ranks the top 100 solutions to climate change. The results are surprising.”

sitting atop the list, with an impact that dwarfs any single energy source: refrigerant management. (Don’t hear much about that, do you? Here’s a great Brad Plumer piece on it.)

Both reduced food waste and plant-rich diets, on their own, beat solar farms and rooftop solar combined.

…

So all these models we see in the popular press, the ones that hit, for example, 80 percent carbon reductions by 2050 — none of those actually reach drawdown?

Paul Hawken: None…And not only that, they’re about energy — they’re all energy models. There’s an assumption that if you get 100 percent renewable [energy], you basically have a hall pass to the 22nd century. That’s simply not true. It’s a scientific howler. It’s extremely important that we [get to 100 percent renewables], but to put all of it on energy …

Somewhat related: Excerpts from Climate change: The rich are to blame, international study finds By Roger Harrabin, 16 March 2020:

…It shows that a fifth of UK citizens are in the top 5% of global energy consumers, along with 40% of German citizens, and Luxembourg’s entire population.Only 2% of Chinese people are in the top global 5% of users, and just 0.02% of people in India.

Even the poorest fifth of Britons consumes over five times as much energy per person as the bottom billion in India.

My first blog post on Huffington Post, “Fintech for Good” – slightly edited version below…

Back in 2009, a global consortium of researchers published a report with a provocative title, “Half of the World is Unbanked”. Five years later, the numbers had already dropped by 20%. Yet close to 2 billion adults globally still do not have access to formal financial services. They remain financially disconnected, without opportunities to increase their incomes, unable to securely save for a rainy day or borrow to improve their lives.

Even basic financial products and services remain out of reach for these people. An illness, accident or a death in the family can spell disaster for their financial situation and cause powerful shocks to their daily lives. These hundreds of millions are effectively locked out of a world which you and I take for granted. It does not have to be so.

Excerpts from “Global Greening versus Global Warming” by Matt Ridley (emphasis added):

…I am increasingly disaffected from science as an institution.

The way it handles climate change is a big part of the reason.

After covering global warming debates as a journalist on and off for almost 30 years, with initial credulity, then growing skepticism, I have come to the conclusion that the risk of dangerous global warming, now and in the future, has been greatly exaggerated while the policies enacted to mitigate the risk have done more harm than good, both economically and environmentally, and will continue to do so.

…Why do I think the risk from global warming is being exaggerated? For four principal reasons.

1. All environmental predictions of doom always are;

2. the models have been consistently wrong for more than 30 years;

3. the best evidence indicates that climate sensitivity is relatively low;

4. the climate science establishment has a vested interest in alarm.

…I will come to those four points in a moment. But first I want to talk about global greening, the gradual, but large, increase in green vegetation on the planet.

…As Myneni’s co-author Zaichun Zhu, of Beijing University, puts it, it’s equivalent to adding a green continent twice the size of mainland USA.

Frankly, I think this is big news. A new continent’s worth of green vegetation in a single human generation.

…Now let me back to global warming.

…These days there is a legion of well paid climate spin doctors. Their job is to keep the debate binary: either you believe climate change is real and dangerous or you’re a denier who thinks it’s a hoax.

But there’s a third possibility they refuse to acknowledge: that it’s real but not dangerous. That’s what I mean by lukewarming, and I think it is by far the most likely prognosis.

I am not claiming that carbon dioxide is not a greenhouse gas; it is.

I am not saying that its concentration in the atmosphere is not increasing; it is.

I am not saying the main cause of that increase is not the burning of fossil fuels; it is.

I am not saying the climate does not change; it does.

I am not saying that the atmosphere is not warmer today than it was 50 or 100 years ago; it is.

And I am not saying that carbon dioxide emissions are not likely to have caused some (probably more than half) of the warming since 1950.

I agree with the consensus on all these points.

I am not in any sense a “denier”, that unpleasant, modern term of abuse for blasphemers against the climate dogma, though the Guardian and New Scientist never let the facts get in the way of their prejudices on such matters. I am a lukewarmer.

The track record on doom

I said that one reason to be skeptical about dangerous climate change is that environmental predictions of doom are always wrong.

Here’s a list of predictions made with much fanfare and extensive coverage in the media in the 1970s, when I was young and green, in both senses of the word:]

…So what is the problem? Well, the theory of dangerous climate change depends on a whole extra step in the argument, one that very few politicians and journalists seem even to know about – the supposed threefold amplification of carbon dioxide’s warming potential, principally by extra water vapour released into the atmosphere by a warming ocean, and accumulating at high altitudes.

…As the distinguished NASA climate scientist Roy Spencer has written,

“If you fund scientists to find evidence of something, they will be happy to find it for you. For over 20 years we have been funding them to find evidence of the human influence on climate. And they dutifully found it everywhere, hiding under every rock, glacier, ocean, and in every cloud, hurricane, tornado, raindrop, and snowflake. So, just tell scientists 20% of their funds will be targeted for studying natural sources of climate change. They will find those, too.”

Does it matter that our politicians panicked in the early 2000s? Surely better safe than sorry?

Here’s why it matters. Our current policy carries not just huge economic costs, which hit the poorest people hardest, but huge environmental costs too.

…

But there is a further reason why it matters. Real environmental problems are being neglected. The emphasis on climate change as the pre-eminent environmental threat means that we pay too little attention to the genuine environmental problems in the world.

We bang on about ocean acidification when it is overfishing and run-off that is most hurting coral reefs.

We misdiagnose climate change as the cause of floods when it is land drainage and urban development that is the cause.

We claim climate change as the cause of extinctions, when it is invasive species that disrupt and damage ecosystems and drive out rare species.

We say climate change is a threat to air quality, when it is climate policy that has hindered progress in improving air quality.

We talk about losing seabird colonies to warming seas and then build wind farms that slaughter the birds while turning a blind eye to overfishing.

Here’s why I really mind about the exaggeration: it has downgraded, displaced and discredited real environmentalism, of the kind I have devoted part of my life to working on.

….In Germany, a 20% increase in renewables between 1999 and 2014 has resulted in no change in emissions at all.

Continue reading “Global Greening versus Global Warming” – Excerpts

Extracts from, “Here’s the huge question facing fintech startups — can they make any money?”

Something strange happened to a few hundred customers of startup, app-only bank Number26 last week — their accounts started closing.

With no explanation other than to cite terms and conditions allowing unexplained account closures, Berlin-based Number26 emailed a clutch of its 160,000 customers to tell them their accounts would shortly be shutting down.

Many customers took to Twitter to complain. This, after all, is a bank that promised to be more like “Uber or Spotify” than a High Street lender.

Number26 told BI in an emailed statement that the account closures were for “various reasons”, including suspicious activity, but admitted at least some of the closures were for a very weird reason indeed — customers using their services too much.

…Essentially, Number26 let users withdraw money for free on the assumption that they wouldn’t really do it very much. But people did use it and it ended up costing Number26 too much money.

This odd incident gets to the heart of a key question asked over and over about the fintech (financial technology) sector — can any of these guys actually make money?

…Many startups have underpinned their promises with services delivered either at cost or with razor-thin profit margins. Think of TransferWise, which charges just 0.5% on top of the mid-market rate on many international money transfers, and Revolut, which lets people spend money at the best rate abroad on its card with no commission.

But these kinds of models aren’t exactly money spinners. While TransferWise’s revenues and total transfers are rocketing, the startup made a loss of £11 million in the year to March 2015, up from just £2 million the year before.

Even Funding Circle — the biggest UK peer-to-peer lender, which takes a cut of loans made over its platform — lost £10.8 million in 2014, the most recent year accounts are available for.

…But critics say many of the business models are unsustainable and simply being supported by the financial teat of venture capital money. The likes of TransferWise and Revolut can only afford to offer such cheap services because of a plentiful supply of free and easy cash from investors that subsidises prices, so the argument goes, not because of any real technical innovation.

…We could be about to see which side is right. VC cash is drying up —with investment in UK fintech startups collapsed 41% in the first quarter of the year. That could spell trouble for business models conceived during the boom times.

Continue reading Fintech startups – Can they make any money?

Interesting excerpts from Digital-only banks face big challenge to usurp traditional high street giants (emphasis added):

“Only a small minority of consumers strongly agree that (online, digital) providers will offer better service, rates, or security than they receive from their existing banks, and well over half would prefer to avoid banks that lack a track record or do not have a high street presence.”

He added: “Consumers’ primary criteria when selecting banks include whether the organisations have an established reputation and conveniently located branches. This plays right into the hands of traditional banks and leaves the challengers at a disadvantage.”

To emphasise the importance of actual walk-in branches, the analysis revealed that although online is growing in significance as an acquisition channel, more than half of current accounts opened between 2013 and 2016 were arranged in-branch.

“Our research finds that, if anything, younger consumers are even more dependent upon branches for day-to-day banking than those in older age groups,” said Mr Fakhri.

“Given that these new entrants are targeting precisely this younger demographic, they will find it particularly difficult to gain significant numbers of customers.”

…Borrowers are sceptical about non-traditional lenders, with over half stating they do want to use lenders that lack established reputations and a minority agreeing that online lenders offer better rates or service.

Continue reading Digital-only banks face big challenge to usurp traditional high street giants

Great to have been at FinSum in Tokyo last week…The energy and excitement was palpable! I participated in a panel that Sheel moderated + led a session on FinTech in Development…

Here are the slides and an artist’s visualization of my talk (it’s flattering!):

Will try and share notes soon…

Watch Milton Friedman explain why such a move might actually hurt the ones it intends to help…

and read why “Raising the Minimum Wage is Still a Bad Idea” and why good intentions end up as bad policy…

Cartoon by Henry Payne, courtesy ValuesandCapitalism.com

..and while on this, here is a thought-provoking, nuanced take on child labour..

…or how important winners are to venture returns and how difficult it is to find them. Excerpts from a recent Seth Levine post (emphasis added):

Based on their data, a full 65% of financings fail to return 1x capital. And perhaps more interestingly, only 4% produce a return of 10x or more and only 10% produce a return of 5x or more.

…This really underscores the challenge of creating a venture portfolio that produces reasonable returns. If you were to actually construct a portfolio based on these averages, a $100M venture fund investing in 20 companies would produce a gross return of approximately $206M (that’s before fees and expenses). The resulting fund would have an IRR in the range of 10% (the exact IRR would depend on the timing of the cash flows, but I constructed a few models to approximate this and 10% was the average return). That’s hardly something to write home about and underscores the challenge of being “average” in this industry.

Hidden in this exercise – and perhaps more important – is the challenge of finding companies at the right side of the distribution chart. In my hypothetical $100M fund with 20 investments, the total number of financings producing a return above 5x was 0.8 – producing almost $100M of proceeds. My theoretical fund actually didn’t find their purple unicorn, they found 4/5ths of that company. If they had missed it, they would have failed to return capital after fees. Even if we doubled the number of portfolio companies in the hypothetical portfolio, a full quarter of the fund’s return comes from the roughly ½ of a company they invested in that generated 10x or above. Had they missed it, they would have produced a return that roughly approximated investing in bonds – not the kind of risk adjusted return they or their investors were looking for.

…All of this math simply underscores how important winners are to venture returns and how difficult it is to find them.

Here’s the sobering chart that accompanied the post:

Related Posts: A very sobering and a humbling reminder..