Looking forward to a “Twilight Taster Session” on Social Entrepreneurship at London Business School this evening!

Social Entrepreneurship Panel Discussion @ Imperial…

Looking forward to a panel discussion on social entrepreneurship at Imperial next month.

After the period of financial turmoil of last few years, there is increasing awareness today that businesses that are solely motivated by bottom line and pure financial profit may be less beneficial for society at large as compared to those who measure their contribution in other ways as well. Many businesses and entrepreneurs now incorporate social costs in their financial decisions. And more companies than ever before are engaged in a serious effort to define and integrate corporate social responsibility into all aspects of their businesses. Whether such companies will eventually outperform those that disregard such measures is something only time will tell.

In this session we will discuss the impact of social strategies on the growth and success of companies.

I will be joined by Susannah Nicklin, CFA, UK Liason, GIIN, Sinead Brophy, CEO, My Support Broker CIC, and Director, The SBC Partnership and Daniel Becerra, Managing Director, Buffulo Grid..

Stay tuned for more…and for further information, please contact entrepreneurship@imperial.ac.uk

“Understanding, Driving and Adapting to Change” – LBS in Mumbai!

Tomorrow afternoon in Mumbai, I’ll be discussing “Understanding, Driving and Adapting to Change” in contemporary India on a panel discussion with 75+ MBA grads from London Business School who are in India on a “Global Business Experience“. I will be sharing my efforts to drive change and systemic reforms in India via political activism..

I will be joined on the panel by Rashmi Bansal, Mukesh Mehta and Gaurav Mehta…Hope to share more details of the interaction soon..

4 lakh illegal rickshaws, 6 lakh illegal vendors and why politics matters – even to entrepreneurs

From my latest post over at Times of India:

“…Did you know that more than 80 percent of the cycle-rickshaws in Delhi are illegal (since there are only 99,000 of them allowed legally)?

Govt functionaries in Delhi extort a crore a month from the cycle-rickshaw pullers alone! This was the figure in 2006. It has probably doubled since then.

Were you aware that Delhi’s approximately 600,000 street vendors operate without the necessary license and pay up about Rs 12 million per month in bribes?

…

Were you aware that a law in the state of Maharashtra requires farmers to sell their sugar cane to a specified sugar mill in the district[i]?

…

Did you know of the law in Kerala which mandates that once a farm is registered as producing one crop, it cannot change its crop without government permission[ii]?!

…

Would it now surprise you to know that “India ranks among the world’s worst countries at encouraging entrepreneurs. For ease of starting a business, India is 166th out of 183 countries”

…

Or that it takes 7 years (yes, seven) to close a business in India and 1,420 days to enforce a contract!

You would think this is a bad joke – except it is not.

…

And millions of small entrepreneurs suffer from this stranglehold of regulations and permits; the vestiges of a still omnipresent (and deeply embedded) license-permit Raj.

Which brings us back to our question: What can the government do?”

Read it in full here.

The 9 cities, 16 days whirl involving 1500 (& a bit more) youngsters!

Here are some memories from the 9 cities, 16 days whirl...that involved 1500 & a bit more) youngsters!

Here is the link to more, qualitative and detailed feedback..

***

https://picasaweb.google.com/s/c/bin/slideshow.swf

***

Related: Announcing Illuminate! and The coming Jobs War & and my own tiny effort: introducing Illuminate!

Sobering. Very Sobering.

From Kauffman Foundation Bashes VCs For Poor Performance, Urges LPs To Take Charge

The Kauffman Foundation, which has ties to the venture industry, has issued a damning study of the business that addresses long-running concerns about poor performance..

…Looking into its portfolio of nearly 100 VC funds, including what it says are some of the most notable and exclusive names (confidentiality agreements barred it from naming them), the foundation found that only 20 of them beat a public-market equivalent by more than 3% annually, and half of those started investing before 1995.

…The report also offers support for the belief that small venture funds are the most successful. Only four of 30 VC funds in the foundation’s portfolio with more than $400 million in committed capital produced returns better than those from a publicly traded small-cap stock index fund.

…The foundation promises to take its own medicine. It said it will invest in venture funds of less than $400 million whose partners have consistently shown they can outperform public markets and who commit at least 5% of the fund’s capital. It also plans to do more direct investing to avoid paying management fees and sharing profits with VCs. And, it plans to shift money from venture capital to the public markets.

On Globalisation and A Changing World…

I delivered the keynote on “A Changing World – Globalisation, Asia, India and China yesterday at ITARC in London. (where I had spoken last year too). Below is an abridged set of slides that formed the backdrop to my talk (minus the images).

***

***

Comments, thoughts welcome as always.

A Sobering (and humbling) Reminder…

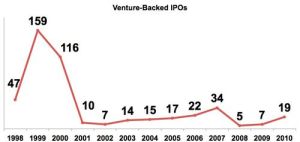

Courtesy Fred Wilson, this chart and the data below (via Mark Suster)…

…using the math I laid out yesterday (roughly 1,000 startups funded each year by VCs), this means that on average between 1% and 3% of venture funded startups get to an IPO.

To recap, 1-3% get to an IPO and 5-10% get to an M&A exit over $100mm. So 85-95% of all venture backed startups will either fail or exit below $100mm.

Nanopost of the month…

…in which I break my self-imposed period of silence. I have a very good reason. I am very pleased and excited to now be formally involved in an extraordinary enterprise in India: Vindhya. Vindhya is extraordinary because:

…almost 95% of its staff of 200 youngsters comprises differently-abled and physically challenged youngsters

Read more about them in this post on my personal blog...and wish us luck in our bold plans for the future.

A nice article and a great piece of news

First the great piece of news: Elements Akademia got included in Gen Next India’s Hottest Start-ups (just 16 companies!):

Click here to read Elements’ story

…and here is the article (strong words but very thought-provoking): How I Judge Investors.