From NY Times, Jun ’17:

**

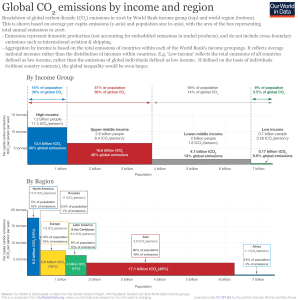

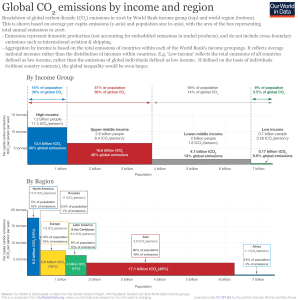

From Our World in Data, Oct ’18:

**

From Axios, Dec ’18 (source chart here):

**

From NY Times, Jun ’17:

**

From Our World in Data, Oct ’18:

**

From Axios, Dec ’18 (source chart here):

**

From my latest post over at Times of India:

“…Did you know that more than 80 percent of the cycle-rickshaws in Delhi are illegal (since there are only 99,000 of them allowed legally)?

Govt functionaries in Delhi extort a crore a month from the cycle-rickshaw pullers alone! This was the figure in 2006. It has probably doubled since then.

Were you aware that Delhi’s approximately 600,000 street vendors operate without the necessary license and pay up about Rs 12 million per month in bribes?

…

Were you aware that a law in the state of Maharashtra requires farmers to sell their sugar cane to a specified sugar mill in the district[i]?

…

Did you know of the law in Kerala which mandates that once a farm is registered as producing one crop, it cannot change its crop without government permission[ii]?!

…

Would it now surprise you to know that “India ranks among the world’s worst countries at encouraging entrepreneurs. For ease of starting a business, India is 166th out of 183 countries”

…

Or that it takes 7 years (yes, seven) to close a business in India and 1,420 days to enforce a contract!

You would think this is a bad joke – except it is not.

…

And millions of small entrepreneurs suffer from this stranglehold of regulations and permits; the vestiges of a still omnipresent (and deeply embedded) license-permit Raj.

Which brings us back to our question: What can the government do?”

Read it in full here.

Here are some memories from the 9 cities, 16 days whirl...that involved 1500 & a bit more) youngsters!

Here is the link to more, qualitative and detailed feedback..

***

https://picasaweb.google.com/s/c/bin/slideshow.swf

***

Related: Announcing Illuminate! and The coming Jobs War & and my own tiny effort: introducing Illuminate!

Shared some slides at the India Investment Opportunities Forum in London yesterday.

I also talked about some of my investments (Myntra, Innoviti and ElementsAkademia) in India.

It was a good interactive session. I felt the mood is turning upbeat (although less so here in London and in the US).

Just a placeholder/note to myself to transcribe my notes/points from the panel discussion at “ChIndia Rising“, Cass Business School last month. I hope to get around to doing this in the next few days.

*** PANEL DETAILS ***

Will the Rising Tide Lift All Boats?

Here the panel will explore in an interactive Q&A session the challenge to the developed world, how to participate in Chindian Growth, the investment challenge, the legal challenge and how to create new opportunities

Panel to include:

Professor Jaideep Prabhu

Professor Bradley Barnes

Manoj Ladwa

Shantanu Bhagwat

Some notes from the “Emerging Markets” seminar on opportunities and challenges for entrepreneurs (part of the IED Best Practice encounters series) at which I shared a panel with Prof. Gerry Geirge and Prof. Chris Toumazou:

I shared a couple of slides (see below) as a preface to my observations:

Earlier this week, I chaired a panel discussion in London at Digital Business India.

Some key points that emerged from the various discussions were:

I hope to add more flavour to these notes later on…

* India added about 15million new mobile subscribers in Jan ’09.

I was here…talking to a bunch of bright people and listening to some great ideas…

Could anything have been more exciting?!

.

Some excerpts from a great article comparing Indian and Chinese M&A, “Dancing “Dragon” and Running “Elephant” on the Stage of M&A by Mark He at Zero2IPO Research.

*** Excerpts Begin (emphasis mine) ***

…

Excerpts from a recent article by Liam Halligan (Chief Economist at Prosperity Capital Management) in The Sunday Telegraph, “China, Brazil and India belong in the G8”

*** Excerpts Begin (emphasis mine) ***

It’s become fashionable to say the G8 is pointless. Last week’s summit of the “world’s advanced industrial democracies” was certainly an anti-climax.

After all the posturing, “working lunches” and “financial stability pacts”, the impotence of the leaders gathered on the Japanese island of Hokkaido was displayed for all to see.

Western shares kept tumbling. Crude hit another record high. As the smell of meltdown turned acrid last week, the markets seemed determined to stress the G8’s irrelevance.

…

Since the mid-1970s, the US, UK, Germany, Italy, Japan, France and Canada have held an annual summit. Russia has recently been added – grudgingly, because four G7 members depend on its oil and gas. Even with Russia, the G8 accounts for only 14 per cent of the world’s population, and less than 60 per cent of the global economy. And that share of worldwide output can only fall as the fast-growing emerging giants continue to outpace the West.

The likes of China, Brazil and India have churned out average annual growth of 5 to 10 per cent for many years now – an expansion rate that’s set to continue. In dollar terms, these countries are now the fourth, 10th and 12th largest economies on earth – and climbing fast.