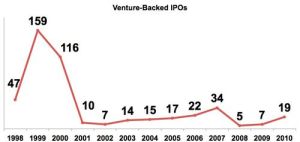

…or how important winners are to venture returns and how difficult it is to find them. Excerpts from a recent Seth Levine post (emphasis added):

Based on their data, a full 65% of financings fail to return 1x capital. And perhaps more interestingly, only 4% produce a return of 10x or more and only 10% produce a return of 5x or more.

…This really underscores the challenge of creating a venture portfolio that produces reasonable returns. If you were to actually construct a portfolio based on these averages, a $100M venture fund investing in 20 companies would produce a gross return of approximately $206M (that’s before fees and expenses). The resulting fund would have an IRR in the range of 10% (the exact IRR would depend on the timing of the cash flows, but I constructed a few models to approximate this and 10% was the average return). That’s hardly something to write home about and underscores the challenge of being “average” in this industry.

Hidden in this exercise – and perhaps more important – is the challenge of finding companies at the right side of the distribution chart. In my hypothetical $100M fund with 20 investments, the total number of financings producing a return above 5x was 0.8 – producing almost $100M of proceeds. My theoretical fund actually didn’t find their purple unicorn, they found 4/5ths of that company. If they had missed it, they would have failed to return capital after fees. Even if we doubled the number of portfolio companies in the hypothetical portfolio, a full quarter of the fund’s return comes from the roughly ½ of a company they invested in that generated 10x or above. Had they missed it, they would have produced a return that roughly approximated investing in bonds – not the kind of risk adjusted return they or their investors were looking for.

…All of this math simply underscores how important winners are to venture returns and how difficult it is to find them.

Here’s the sobering chart that accompanied the post:

Related Posts: A very sobering and a humbling reminder..